Warren Buffett stocks: How to invest like a Billionaire

Warren Buffett, the Chairman and CEO of Berkshire Hathaway ($BRK.B), is often simplified by the mainstream media as a “folksy” investor from Omaha. In reality, he is the architect of the world’s most formidable capital allocation machine. Berkshire Hathaway is not merely a company; it is a diversified fortress designed to weather every economic cycle of the last century.

As part of the Michael C. Fanning Online Community, we analyze Buffett not just for his “wins,” but for his discipline in identifying durable competitive advantages—the “moats” that protect capital from the erosion of competition.

The Philosophy: “Invest in a business any idiot can run...”

Buffett famously remarked that one should invest in a business so simple that an idiot could run it, “because eventually, one will.” This speaks to his core requirement: Systems over Stardom. He seeks companies where the business model is so robust that it does not require a genius at the helm to generate outsized returns.

The Berkshire Infrastructure: Beyond the Stock Ticker

To understand Buffett, you must look past the publicly traded equities. Berkshire Hathaway’s strength lies in its dual-layered structure:

Wholly Owned Subsidiaries: Berkshire owns more than 65 companies outright, providing massive “float” and consistent cash flow. This includes giants like GEICO, Duracell, BNSF Railway, and Dairy Queen.

The Equity Portfolio: This is where Buffett deploys excess capital into “wonderful businesses at fair prices.” His favorite holding period is not a quarter or a year; it is forever.

The Paradox of Technology

For decades, Buffett’s “Fringe” stance was his refusal to invest in the tech sector, stating,

“I won’t invest in tech companies because I don’t understand them.”

However, as the world evolved, so did the definition of a “moat.” Buffett eventually realized that Apple ($AAPL) was no longer just a “tech company”—it had become a consumer staples giant with an ecosystem stickier than Coca-Cola. Today, Apple is the undisputed crown jewel of his equity portfolio.

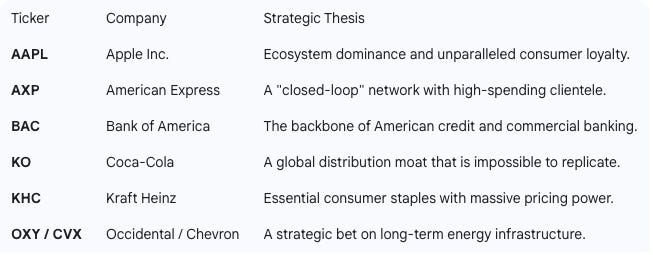

The Core Holdings: Where the Capital Resides

Buffett’s portfolio is highly concentrated. He does not believe in “diworsification.” He bets heavily on his highest convictions.

Note: While Berkshire has historically held significant stakes in the banking sector (USB, BK, WFC) and airlines (DAL), Buffett is known to exit entire sectors rapidly when the “moat” begins to take on water.

The Community Takeaway

The lesson for our community is clear: Wealth is built through concentration and time. Buffett doesn’t trade the noise; he buys the infrastructure of modern life. He looks for businesses that generate cash while he sleeps and holds them until the narrative changes—which, for him, is rarely.